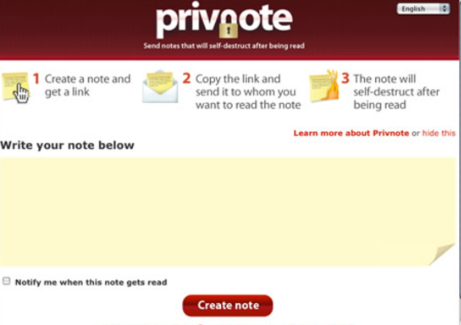

Are you currently considering shielding your retirement living financial savings by using actual physical golden? In that case, starting a Goldco IRA may be the appropriate choice for you. In this article, we’ll offer a summary of what a Goldco IRA is and the way it works.

Just what is a Goldco IRA?

A Goldco Specific Retirement Bank account (IRA) is undoubtedly an personal retirement profile that enables brokers to purchase and own treasured precious metals including gold, sterling silver, platinum and palladium within the IRA. The thought behind a Goldco IRA is to branch out your retirement stock portfolio with the addition of gold or some other precious aluminum purchases in your overall investment method. Using a Goldco IRA, you can get actual metallic coins or cafes without paying any tax upfront on the aluminum itself. This simply means that you can to get treasured materials with pre-taxation bucks, that could potentially provide you with some taxation positive aspects down the road.

So How Exactly Does a Goldco IRA Function?

A Goldco IRA performs just like any other traditional or Roth personal retirement account. You wide open a free account by having an approved custodian which will carry your possessions and facilitate transactions according to IRS restrictions. When your accounts continues to be established and funded, you can start investing in gold or another precious metals via exchanges out of your existing profiles or through primary buys through the custodian’s accredited list of merchants. In regards a chance to offer your purchases down the road, any income earned will be taxed on the appropriate investment capital results amount based on your revenue degree at that time.

Great things about Committing Using a Goldco IRA

There are numerous pros connected with investing in precious metal or other cherished precious metals employing a Goldco IRA. Very first, investing in bodily precious metal gives profile diversification and protection against rising cost of living as precious metal costs usually boost when stock marketplaces drop as a result of monetary anxiety or worldwide events. In addition, several traders see having actual physical precious metal as significantly less unsafe than papers-centered assets like bonds and stocks since there is no counterparty danger linked to holding bodily bullion—the price of golden will not depend on the efficiency of some other organization or organization’s monetary well being. Finally, if done efficiently, committing with a Goldco fees can provide substantial tax advantages in comparison to buying/marketing bodily bullion directly outside a person pension bank account composition.

Bottom line:

Gold IRAs are becoming increasingly popular among brokers researching ways to protect their retirement living price savings whilst benefiting from possible tax benefits associated with having bodily resources inside an personal pension profile framework. If you’re thinking of opening up one oneself, make sure you do some research first—there are not the same varieties accessible plus they all come with their own personal group of regulations and rules that need to be implemented for concurrence purposes. Moreover, numerous custodians offer you further solutions like stock portfolio evaluations which will help guide making decisions in regards time for undertaking trades in the account alone.